Journée d’études

Journée d’études « Réseaux et finance dans le long terme » - Toulouse Business School (amphithéâtre Bosco), jeudi 30 juin 2016

Organisateurs :

David LE BRIS, Toulouse Business School (d.le-bris@tbs-education.fr)

Stefano UGOLINI, Sciences Po Toulouse et LEREPS (stefano.ugolini@ut-capitole.fr)

Inscription gratuite mais obligatoire

Programme préliminaire

10h00-10h20 : Petit-déjeuner

10h20-10h30 : Mots de bienvenue et introduction de la journée

10h30-12h30 : Session I : Réseaux interpersonnels et développement économique

- David LE BRIS (Toulouse Business School) : « Alternative Paths to the Development of the Corporate Form » (avec William GOETZMANN et Sébastien POUGET)

- Ronan TALLEC (Université Paris 1 Panthéon-Sorbonne) : « Property and Family in Montesquieu-Volvestre, 1700-1790 »

- Claire LEMERCIER (Sciences Po Paris, CSO) : « How Embedded Were the Relationships between European Merchants ? 1750-1850 » (avec Arnaud BARTOLOMEI, Fabien ELOIRE, Matthieu DE OLIVEIRA et Nadège SOUGY)

12h30-14h00 : Déjeuner

14h00-16h00 : Session II : Réseaux bancaires et stabilité financière

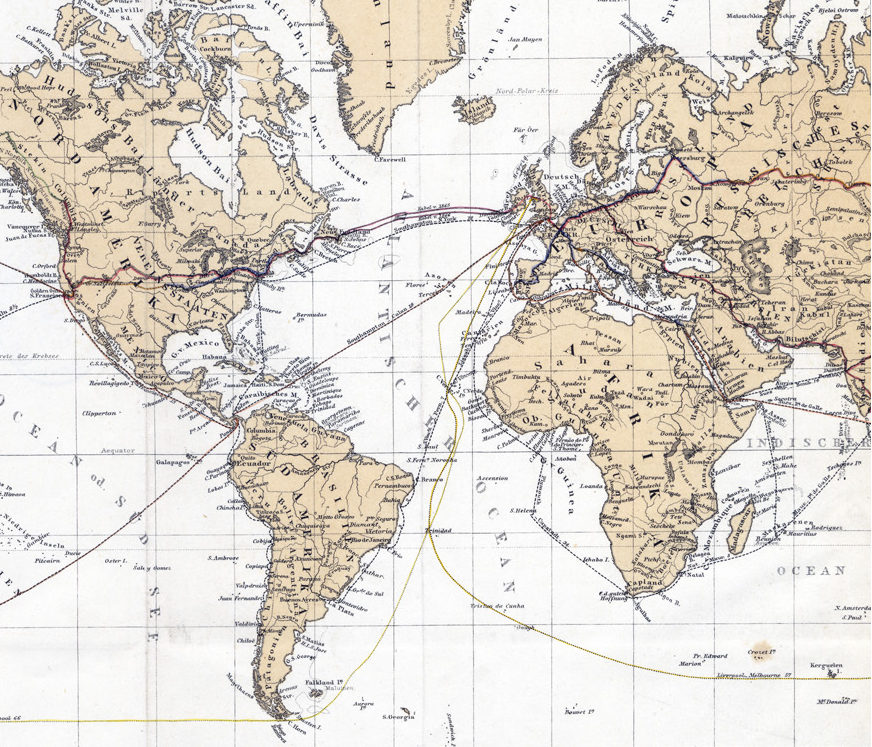

- Stefano UGOLINI (Sciences Po Toulouse, LEREPS) : « A Network Analysis of the International Financial System During the First Globalization » (avec Olivier ACCOMINOTTI et Delio LUCENA-PIQUERO)

- Olivier ACCOMINOTTI (London School of Economics) : « Global Banking and the International Transmission of the 1931 Financial Crisis »

- Elisa GRANDI (Université Paris Diderot, CESSMA) : « Banks and Networks at the Belle Époque : Performance and Stability » (avec Raphaël HEKIMIAN et Angelo RIVA)

16h00-16h30 : Café

16h00-18h00 : Session III : Réseaux commerciaux et structures de marché

- Pilar NOGUÉS-MARCO (Université de Genève) : « Anglo-Asian Market Integration in the Early Modern Period (1600s-1800s) : Measuring Price Convergence for the East India Company Importables »

- Thi-Hong-Van HOANG (Montpellier Business School) : « The Paris Clandestine Gold Market during World War II : Who Were the Participants ? » (avec Georges GALLAIS-HAMONNO et Kim OOSTERLINCK)

- Olivier BROSSARD (Sciences Po Toulouse, LEREPS) : « Venture Capitalist Networks’ Structure and Geographic Proximity : A Cross-Country Empirical Study » (avec Amélie ADATTE)

18h00-18h30 : Table ronde : qu’avons-nous appris ?

Abstracts

Session I : Interpersonal Networks and Economic Development

David LE BRIS (Toulouse Business School) : « Alternative Paths to the Development of the Corporate Form » (avec William GOETZMANN et Sébastien POUGET)

Alternative paths to the corporate form allowing impersonal cooperation are documented from medieval organizations especially the Toulouse mills and Casa San Giorgio. Two existing institutions favored these innovations : the Communes and the equal inheritance rule of Roman law. These corporate forms emerged as a solution to reduce transaction costs when dividing an asset. These institutional innovations are independent from the emergence of the corporate form in 17th-century Northern Europe even if some cross-fertilization can be identified. Comparing the result of these different evolutions at the eve of the industrial revolution, the most modern appears to be the Toulouse mills. This institutional modernity has not been crucial for the economic take-off.

Ronan TALLEC (Université Paris 1 Panthéon-Sorbonne) : « Property and Family in Montesquieu-Volvestre, 1700-1790 »

This presentation analyses shifts in the relation of families, households and individuals in a Languedocian village during the transition to a modern social structure. It attempts to undercover the tenor of marital relationships within a particular context of production : as population increased and an influx of capital brought about a reorganisation of agricultural and rural industry, kinship became more flexible and more useful for managing the forces of social reproduction. As will be seen, peasants and weavers were innovative and flexible, experimenting with new commodity markets and developing a flexible set of exchanges with financial guarantees.

Claire LEMERCIER (Sciences Po Paris, CSO) : « How Embedded Were the Relationships between European Merchants ? 1750-1850 » (avec Arnaud BARTOLOMEI, Fabien ELOIRE, Matthieu DE OLIVEIRA et Nadège SOUGY)

Standard narratives of commercial modernization describe a shift from relationships embedded in families or diasporas to more anonymous, market-oriented interactions supported by laws. This research project aims at testing and qualifying this general narrative on the basis of three types of empirical sources : powers of attorney ; the opening letters in corpora of commercial correspondence ; and printed circular letters (a device that supposedly supported the creation of disembedded commercial relationships). The systematic study of such sources shed lights on alternative hypotheses as regards the embeddedness of commercial relationships. Embedded and disembedded relationships appear as complements rather than substitutes. This very dichotomy is qualified by the importance of weak ties (repeated but disembedded relationships) and of an homophily that is loosely based on mutual recognition as genuine merchants.

Session II : Banking Networks and Financial Stability

Stefano UGOLINI (Sciences Po Toulouse, LEREPS) : « A Network Analysis of the International Financial System During the First Globalization » (avec Olivier ACCOMINOTTI et Delio LUCENA-PIQUERO)

This paper analyzes the structure of the international financial system at the heyday of the first globalization. Using a unique dataset (collected from a previously unexploited archival source) describing the origination and distribution of bills of exchange in the London market, we reconstruct the complete network of financial linkages between agents involved in the design and circulation of money market instruments. Our preliminary findings indicate that the pre-WW1 international financial system did not exhibit the core-periphery structure characteristic of the modern global banking network. We draw implications for the system’s overall stability and its resilience to shocks.

Olivier ACCOMINOTTI (London School of Economics) : « Global Banking and the International Transmission of the 1931 Financial Crisis »

This paper explores the impact of the Central European crisis of the summer of 1931 on US and British banks. Using archival bank-level data, I document US and British banks’ asset side exposure to Germany, Austria and Hungary in 1931. The freeze of Central European assets left few US banks insolvent but endangered much more British financial institutions. In Britain, Central European frozen credits were mostly held by small and poorly diversified banks with little capital to absorb losses. In the United States, Central European credits were mostly held by large and diversified banks which were better able to cushion the shock of the German crisis. Differences in the organization of foreign banking between the two creditor countries explain why the Central European crisis transmitted to London but not New York in 1931.

Elisa GRANDI (Université Paris Diderot, CESSMA) : « Banks and Networks at the Belle Époque : Performance and Stability » (avec Raphaël HEKIMIAN et Angelo RIVA)

This paper aims at measuring the impact of the interlocking directorates on French banks’ performance on the stock market between 1883 and 1913. Using the Yearbooks as main source, we collect data on the directorates of all the French banks listed on the Paris Official Stock Exchange in order to compute their centrality in the network. The analysis focuses then on the five largest commercial banks of the period and assesses the explanatory power of directors’ networks in stocks returns over time.

Session III : Commercial Networks and Market Structures

Pilar NOGUÉS-MARCO (Université de Genève) : « Anglo-Asian Market Integration in the Early Modern Period (1600s-1800s) : Measuring Price Convergence for the East India Company Importables »

The debate on the intercontinental market integration before the 19th century remains open because there are contradictory proofs on price convergence. This research measures Anglo-Asian market integration focusing on the main commodities imported by the East India Company (EIC) : piece goods (Indian cotton textiles), tea and pepper. First, I have hand-collected yearly unitary prices in Asia and London for pepper (1615-1796), tea (1701-1828), and cotton textiles (1664-1806). Different commodities show a different pattern when measuring price convergence. In order to interpret results and using also the data available in the EIC archive, I calculate which percentage represented each component of the price gaps for each commodity in the long run : customs, freights, charges, company net mark-up and retailers mark-up. Results show that transport costs represented only a small percentage of the price wedge. Market disintegration was the outcome of legal trade barriers. Market structure and business strategy explain intercontinental market disintegration in early modern period.

Thi-Hong-Van HOANG (Montpellier Business School) : « The Paris Clandestine Gold Market during World War II : Who Were the Participants ? » (avec Georges GALLAIS-HAMONNO et Kim OOSTERLINCK)

This presentation focuses on the black market for gold in Paris during World War II with a particular attention on its functioning and its participants. We rely on several sources of archives such as the National Archives of France, Banque de France and also Swiss Archives. We show that this market was not so “black” because, besides the existence of an exceptional daily database, the German occupiers were active participants intensifying international arbitrages with Switzerland. We also present some quantitative aspects of this market such as extreme values’ analysis and informational efficiency.

Olivier BROSSARD (Sciences Po Toulouse, LEREPS) : « Venture Capitalist Networks’ Structure and Geographic Proximity : A Cross-Country Empirical Study » (avec Amélie ADATTE)

The literature on Venture Capitalists (VCs) shows that syndication networks contribute to the success of both investors (VCs) and investees (start-up companies) and that there this is a strong relational commitment between the two. This commitment can be more or less efficient depending on the form of proximity it entails, viz. either geographic proximity (frequent face-to-face interaction between VCs and managers) or network proximity (frequent collaboration between VCs). In order to study the occurrence of these two forms of proximity in VC syndication networks, we build a large dataset using extractions from the Dow Jones’ Venture Source Database covering all the countries and time periods reported in this data source. We obtain a sample of 72,000 deals regarding 30,000 start-ups and involving 8,000 VC investors. These start-ups have been created between 1980 and 2014 in 11 different countries. Our preliminary results show that the characteristics of VC deals, VC investors and VC networks are quite heterogeneous across countries. They also suggest that VC networks generate the main connections and centrality in syndication networks and positively contribute to the success of both VCs and start-ups.