Abstract

The main objective of this study is to assess the impact of unobserved heterogeneity on microfinance social efficiency analysis. Based on recent nonparametric techniques and directional distances, we identify a latent heterogeneity factor related to the microfinance institute (MFI) manager’s ability to promote women, independent of MFI size. We test for the significance of this unobserved factor and analyze the impact of MFI social inefficiency measures. Using a cross-country sample of 501 MFIs in 2011 from six main regions of the world, our findings reveal a significant effect of unobserved heterogeneity on the frontier and hence stress the importance of subjective factors in defining the set of production possibilities. We assess the robustness of our findings with the considered profit-oriented status and analyze the link between our unobserved heterogeneity factor and institutional and socioeconomic indicators.

Similar content being viewed by others

Notes

Note that the analysis performed below has also been repeated in 2010 and 2012 to check for robustness of our results. The results were consistent with 2011 but we chose not to include them in the paper to save space.

This explains in particular why our sample size is smaller than in Fall et al. (2021). Indeed, we have introduced several new variables to characterise the unobserved heterogeneity (one auxiliary variable and six external socio-economic variables) and datapoints for these variables were sometimes missing for the year 2011. Dropping cross-sections with missing data lead us to base our analysis on a sample of 501 MFIs.

Note that, as suggested by a peer reviewer, we could have completed the analysis by using the number of female loan officers as an additional observed heterogeneity factor [as in Fall et al. (2021)]. We chose a single heterogeneity factor and favored the representation of women on the boards of directors for one main reason: targeting women is a strategic decision in MFIs and this strategic decision must be ratified by the board of Footnote 4 Continued

directors. Having women represented on the boards of directors can therefore encourage MFIs to deliver more financial services to women (financial inclusion of women).

References

Abdullah, S., & Quayes, S. (2016). Do women borrowers augment financial performance of MFIs? Applied Economics, 48(57), 5593–5604.

Andreou, P. C., Philip, D., & Robejsek, P. (2016). Bank liquidity creation and risk-taking: Does managerial ability matter? Journal of Business Finance & Accounting, 43(1–2), 226–259.

Aragon, Y., Daouia, A., and Thomas-Agnan, C. (2005). Nonparametric frontier estimation: a conditional quantile-based approach. Econometric Theory, 21, 358–389.

Armendáriz, B. and Morduch, J. (2010). The economics of microfinance. MIT press.

Assefa, E., Hermes, N., & Meesters, A. (2013). Competition and the performance of microfinance institutions. Applied Financial Economics, 23(9), 767–782.

Banerjee, A., Duflo, E., Glennerster, R., & Kinnan, C. (2015). The miracle of microfinance? evidence from a randomized evaluation. American Economic Journal: Applied Economics, 7(1), 22–53.

Banerjee, A., Karlan, D., & Zinman, J. (2015). Six randomized evaluations of microcredit: Introduction and further steps. American Economic Journal: Applied Economics, 7(1), 1–21.

Bank, W. (2021). The World Bank Annual Report 2021: From Crisis to Green, Resilient, and Inclusive Recovery. The World Bank.

Banna, H., Rana, M. S., Ismail, I., & Ismail, N. (2019). Quantifying the managerial ability of microfinance institutions: Evidence from latin america. Journal of International Development, 31(7), 578–600.

Barry, T. A., & Tacneng, R. (2014). The impact of governance and institutional quality on mfi outreach and financial performance in sub-saharan africa. World Development, 58, 1–20.

Battilana, J., & Dorado, S. (2010). Building sustainable hybrid organizations: The case of commercial microfinance organizations. Academy of Management Journal, 53(6), 1419–1440.

Berger, A. N., & Udell, G. F. (2002). Small business credit availability and relationship lending: The importance of bank organisational structure. The Economic Journal, 112(477), F32–F53.

Blanco-Oliver, A., Reguera-Alvarado, N., & Veronesi, G. (2021). Credit risk in the microfinance industry: The role of gender affinity. Journal of Small Business Management, 59(2), 280–311.

Branisa, B., Klasen, S., & Ziegler, M. (2013). Gender inequality in social institutions and gendered development outcomes. World Development, 45, 252–268.

Branisa, B., Klasen, S., Ziegler, M., Drechsler, D., & Jütting, J. (2014). The institutional basis of gender inequality: The social institutions and gender index (sigi). Feminist Economics, 20(2), 29–64.

Cazals, C., Florens, J.-P., & Simar, L. (2002). Nonparametric frontier estimation: a robust approach. Journal of Econometrics, 106(1), 1–25.

Chambers, R. G., Chung, Y., & Färe, R. (1996). Benefit and distance functions. Journal of Economic Theory, 70(2), 407–419.

Chen, X., & Lu, C.-C. (2021). The impact of the macroeconomic factors in the bank efficiency: evidence from the chinese city banks. The North American Journal of Economics and Finance, 55, 101294.

Cozarenco, A., & Szafarz, A. (2018). Gender biases in bank lending: Lessons from microcredit in france. Journal of Business Ethics, 147(3), 631–650.

Cull, R., Demirgü ç Kunt, A., & Morduch, J. (2007). Financial performance and outreach: A global analysis of leading microbanks. The Economic Journal, 117(517), F107–F133.

Cull, R., Demirguc-Kunt, A., & Morduch, J. (2011). Does regulatory supervision curtail microfinance profitability and outreach? World Development, 39(6), 949–965.

Curi, C., & Lozano-Vivas, A. (2020). Managerial ability as a tool for prudential regulation. Journal of Economic Behavior & Organization, 174, 87–107.

Daraio, C., & Simar, L. (2005). Introducing environmental variables in nonparametric frontier models: a probabilistic approach. Journal of Productivity Analysis, 24(1), 93–121.

Daraio, C., & Simar, L. (2007). Advanced robust and nonparametric methods in efficiency analysis: Methodology and applications. Springer Science & Business Media.

Daraio, C., & Simar, L. (2014). Directional distances and their robust versions: Computational and testing issues. European Journal of Operational Research, 237(1), 358–369.

Daraio, C., Simar, L., and Wilson, P. W. (2020). Fast and efficient computation of directional distance estimators. Annals of Operations Research, 288, 1–31.

Daraio, C., Simar, L., & Wilson, P. W. (2021). Quality as a latent heterogeneity factor in the efficiency of universities. Economic Modelling, 99, 105485.

De Franco, G., Hope, O.-K., & Lu, H. (2017). Managerial ability and bank-loan pricing. Journal of Business Finance & Accounting, 44(9–10), 1315–1337.

Demerjian, P., Lev, B., & McVay, S. (2012). Quantifying managerial ability: A new measure and validity tests. Management Science, 58(7), 1229–1248.

Demerjian, P. R., Lev, B., Lewis, M. F., & McVay, S. E. (2013). Managerial ability and earnings quality. The Accounting Review, 88(2), 463–498.

D’espallier, B., Guerin, I., & Mersland, R. (2013). Focus on women in microfinance institutions. The Journal of Development Studies, 49(5), 589–608.

Fall, F. S., Tchuigoua, H. T., Vanhems, A., & Simar, L. (2021). Gender effect on microfinance social efficiency: A robust nonparametric approach. European Journal of Operational Research, 295(2), 744–757.

Goodell, J. W., Goyal, A., & Hasan, I. (2020). Comparing financial transparency between for-profit and nonprofit suppliers of public goods: Evidence from microfinance. Journal of International Financial Markets, Institutions and Money, 64, 101146.

Gutiérrez-Nieto, B., Serrano-Cinca, C., & Mar Molinero, C. (2009). Social efficiency in microfinance institutions. Journal of the Operational Research Society, 60(1), 104–119.

Hartarska, V., & Mersland, R. (2012). Which governance mechanisms promote efficiency in reaching poor clients? evidence from rated microfinance institutions. European financial management, 18(2), 218–239.

Hartarska, V., & Nadolnyak, D. (2007). Do regulated microfinance institutions achieve better sustainability and outreach? cross-country evidence. Applied economics, 39(10), 1207–1222.

Hartarska, V., Nadolnyak, D., & Mersland, R. (2014). Are women better bankers to the poor? evidence from rural microfinance institutions. American Journal of Agricultural Economics, 96(5), 1291–1306.

Hermes, N., & Lensink, R. (2011). Microfinance: its impact, outreach, and sustainability. World Development, 39(6), 875–881.

Kaufmann, D., Kraay, A., & Mastruzzi, M. (2011). The worldwide governance indicators: Methodology and analytical issues1. Hague Journal on the Rule of Law, 3(2), 220–246.

Mastromarco, C., & Simar, L. (2021). Latent heterogeneity to evaluate the effect of human capital on world technology frontier. Journal of Productivity Analysis, 55(2), 71–89.

Meager, R. (2019). Understanding the average impact of microcredit expansions: A bayesian hierarchical analysis of seven randomized experiments. American Economic Journal: Applied Economics, 11(1), 57–91.

Moradi-Motlagh, A. and Emrouznejad, A. (2022). The origins and development of statistical approaches in non-parametric frontier models: a survey of the first two decades of scholarly literature (1998–2020). Annals of Operations Research, 318, 1–29.

Nyarko, S. A. (2022). Gender discrimination and lending to women: The moderating effect of an international founder. International Business Review, 31(4), 101973.

Piot-Lepetit, I., & Nzongang, J. (2014). Financial sustainability and poverty outreach within a network of village banks in cameroon: A multi-DEA approach. European Journal of Operational Research, 234(1), 319–330.

Piot-Lepetit, I. and Tchakoute Tchuigoua, H. (2021). Ownership and performance of microfinance institutions in latin america: A pseudo-panel malmquist index approach. Journal of the Operational Research Society, pages 1–14.

Pitt, M. M., Khandker, S. R., & Cartwright, J. (2006). Empowering women with micro finance: Evidence from bangladesh. Economic Development and Cultural Change, 54(4), 791–831.

Racine, J. (1997). Consistent significance testing for nonparametric regression. Journal of Business & Economic Statistics, 15(3), 369–378.

Sen, A. (2014). Development as freedom (1999). The globalization and development reader: Perspectives on development and global change, 525.

Shahriar, A. Z. M., Unda, L. A., & Alam, Q. (2020). Gender differences in the repayment of microcredit: The mediating role of trustworthiness. Journal of Banking & Finance, 110, 105685.

Simar, L. (2003). Detecting outliers in frontier models: A simple approach. Journal of Productivity Analysis, 20(3), 391–424.

Simar, L., & Vanhems, A. (2012). Probabilistic characterization of directional distances and their robust versions. Journal of Econometrics, 166(2), 342–354.

Simar, L., Vanhems, A., & Van Keilegom, I. (2016). Unobserved heterogeneity and endogeneity in nonparametric frontier estimation. Journal of Econometrics, 190(2), 360–373.

Simar, L., & Wilson, P. W. (2007). Estimation and inference in two-stage, semi-parametric models of production processes. Journal of Econometrics, 136(1), 31–64.

Simar, L., & Wilson, P. W. (2011). Two-stage DEA: caveat emptor. Journal of Productivity Analysis, 36(2), 205.

Vo, X. V., Pham, T. H. A., Doan, T. N., & Luu, H. N. (2021). Managerial ability and bank lending behavior. Finance Research Letters, 39, 101585.

Wilson, P. W. (2018). Dimension reduction in nonparametric models of production. European Journal of Operational Research, 267(1), 349–367.

Yin, H. (2021). The impact of competition and bank market regulation on banks’ cost efficiency. Journal of Multinational Financial Management, 61, 100677.

Zheng, C., & Zhang, J. (2021). The impact of covid-19 on the efficiency of microfinance institutions. International Review of Economics & Finance, 71, 407–423.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix: Tables and Figures

Appendix: Tables and Figures

1.1 Impact of heterogeneity variables on the frontier and inefficiency

Gender effect (unobserved and observed heterogeneity) for the full sample. The three figures on the left correspond to the effect on the frontier, and the three figures on the right correspond to the effect on the inefficiency level. The two figures on the top correspond to the 3D plot with the observed and unobserved heterogeneity (observed heterogeneity is % of Female board members). The two figures in the middle (in the bottom) correspond to the 2-D plot with the observed heterogeneity (unobserved heterogeneity) for the quantile values of the unobserved heterogeneity (observed heterogeneity). The symbols for the three quantile values are \(\triangledown \) for Q1, * for Q2 and o for Q3. The pvalues correspond to the test evaluating the impact of the heterogeneity variable on the frontier or on the inefficiency level

Gender effect (unobserved and observed heterogeneity) for the for-profit sample. The three figures on the left correspond to the effect on the frontier, and the three figures on the right correspond to the effect on the inefficiency level. The two figures on the top correspond to the 3D plot with the observed and unobserved heterogeneity (observed heterogeneity is % of Female board members). The two figures in the middle (in the bottom) correspond to the 2-D plot with the observed heterogeneity (unobserved heterogeneity) for the quantile values of the unobserved heterogeneity (observed heterogeneity). The symbols for the three quantile values are \(\triangledown \) for Q1, * for Q2 and for Q3. The pvalues correspond to the test evaluating the impact of the heterogeneity variable on the frontier or on the inefficiency level

Gender effect (unobserved and observed heterogeneity) for the nonprofit sample. The three figures on the left correspond to the effect on the frontier, and the three figures on the right correspond to the effect on the inefficiency level. The two figures on the top correspond to the 3D plot with the observed and unobserved heterogeneity (observed heterogeneity is % of Female board members). The two figures in the middle (in the bottom) correspond to the 2-D plot with the observed heterogeneity (unobserved heterogeneity) for the quantile values of the unobserved heterogeneity (observed heterogeneity). The symbols for the three quantile values are \(\triangledown \) for Q1, * for Q2 and o for Q3. The pvalues correspond to the test evaluating the impact of the heterogeneity variable on the frontier or on the inefficiency level

1.2 Characterization of the unobserved heterogeneity

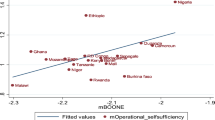

See Fig. 4.

Link between the unobserved heterogeneity and external variables: a Government effectiveness; b Voice and accountability; c Rule of law; d Gender Inequality Index (GII); e Gender Development Index (GDI); and f Human Development Index (HDI). The inverted triangles represent the local linear fit to the sample of points. The pvalues correspond to the test evaluating the impact of the external variable on the unobserved heterogeneity

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Fall, F.S., Tchakoute Tchuigoua, H., Vanhems, A. et al. Investigating the unobserved heterogeneity effect on outreach to women: lessons from microfinance institutions. Ann Oper Res 328, 1365–1386 (2023). https://doi.org/10.1007/s10479-023-05353-y

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-023-05353-y